110% Super bonus: Eco Bonus and Anti-Seismic Bonus

Types of interventions, constraints, and deductions.

The Law No. 34 of 19 May 2020 has introduced the new "Relaunch" decree which widens the percentage of deduction due in the event of energy and seismic redevelopment of properties, by increasing the percentage up to 110% for the expenses incurred from 01.07.2020 to 31.12.2021; it has also introduced significant differences compared to the previous deductions (which remain effective without changes).

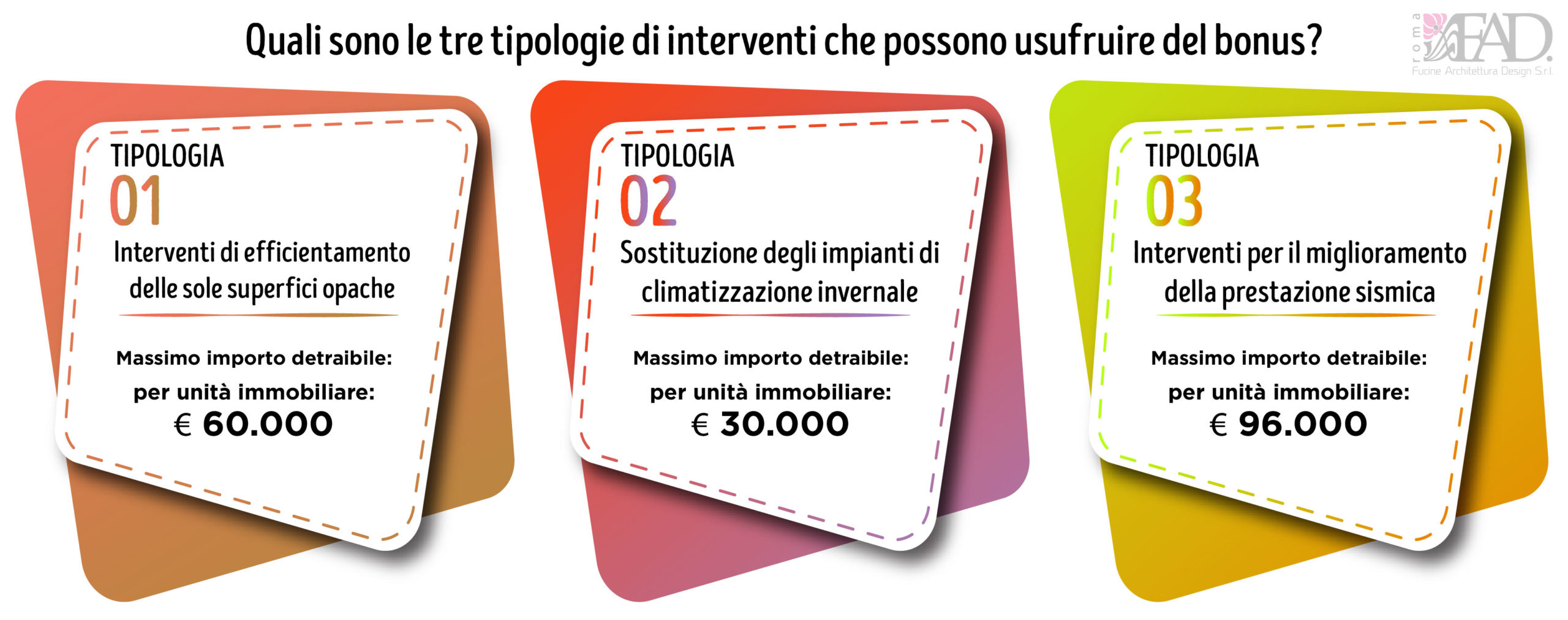

In which cases can we take advantage of the bonus? The following three types of intervention are entitled to benefit from the bonuses.

- Efficiency measures for opaque surfaces only: it concerns the transparent surfaces, that is the fixtures, which benefit from the usual deductions provided for by previous decrees.

- To obtain the bonus, the intervention must concern more than 25% of the dissipating surface, calculated net of transparent surfaces. The decree refers to flat opaque surfaces only; sloped roofs are therefore excluded. The maximum expenditure ceiling is set at € 60,000 per real estate unit (in the case of condominium consisting of different units, the amount must be considered for each individual unit). So, the entire building / condominium must be considered, not the single real estate unit only.

- Replacement of winter climate control systems: the intervention must not concern the replacement of the heat generator only with a more performing system; it must involve the entire system (distribution system and terminals). The newness is the introduction of the summer climate control system. In this case, the maximum deductible amount is € 30,000 per real estate unit.

- Interventions for the improvement of the seismic performance of buildings, with a maximum expenditure ceiling set at € 96,000 per real estate unit; it is unnecessary to specify that the entire condominium must be considered.

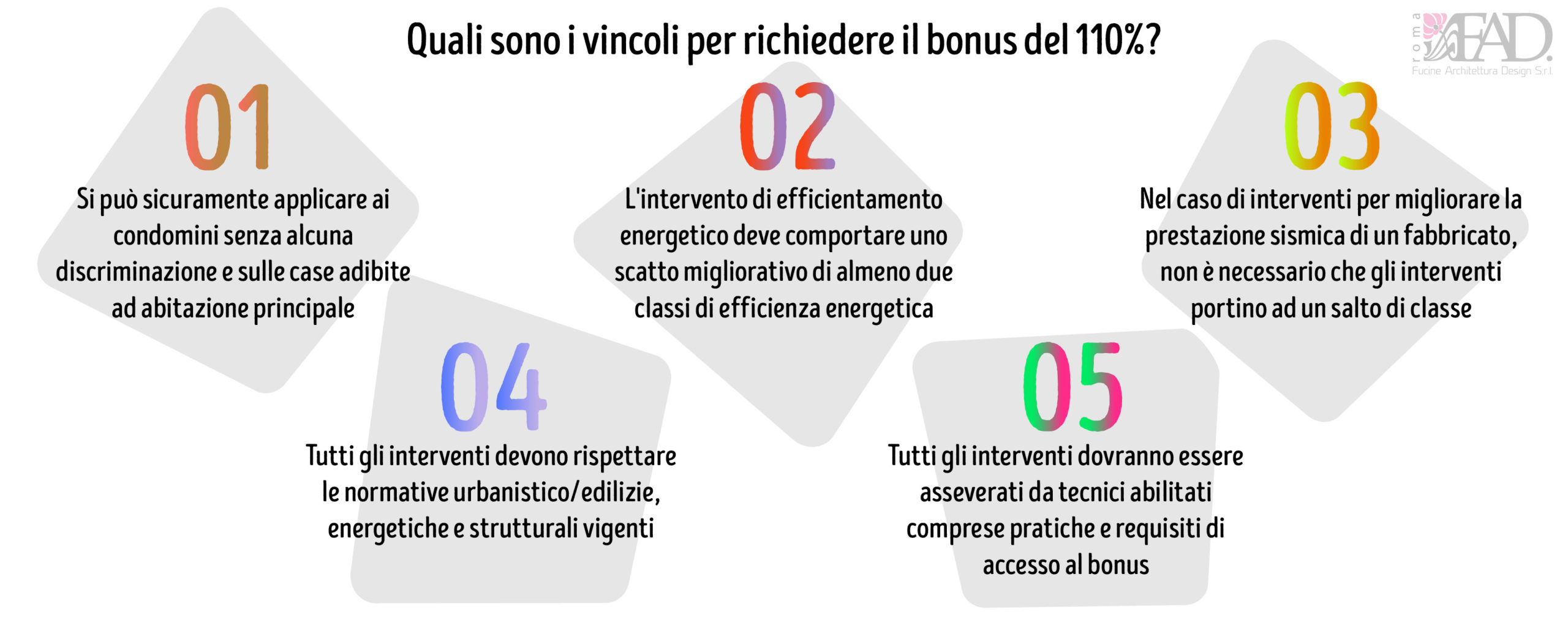

Which are the constraints to request the 110% bonus?

- Unlike the canonical bonuses, the 110% bonus cannot be indiscriminately applied to all residential properties. It can be certainly applied to condominiums and to houses designated as primary residences (that are different from the main dwellings). Second homes are expressly excluded, except when they are part of a condominium (in this case, it is possible to benefit from the bonus as the interventions concern the entire condominium).

- The energy efficiency intervention must involve a level improvement of at least two energy efficiency classes (certified by the drafting of two Energy Performance Certificates, one issued before and one after the intervention). If the improvement graduation cannot be obtained, it will be necessary to reach the highest energy efficiency class.

- In the case of interventions aimed at improving the seismic performances of a building, it is not necessary to "obtain" a level improvement, it will be sufficient to obtain an actual seismic improvement of the structures.

- All interventions must comply with the town planning / building, energy, and structural regulations in force.

- All interventions must be asseverated by qualified technicians, who must also asseverate the congruousness of the prices applied and ensure that all the necessary requirements to access the bonuses are complied.

How to benefit from the deduction?

- Total or partial transfer of the tax credit to third parties: in this case, the taxpayer pays the expenditure in advance on the invoice, but he / she subsequently transfers his / her tax credit to a Bank or to other financial intermediaries, to obtain an immediate refund of the expenditure incurred;

- Invoice discount: the credit may be also directly transferred to the company appointed for the works. In this case, the discount is applied on the invoice and the company could then use the 110% credit as clearing for the payment of taxes or transfer it to the Banks.

The information therein refers to the Regulatory Provisions currently in force (end of May 2020). Following any updates of the Regulatory Provisions, data and information therein may be affected by changes or additions.