Building Bonuses 2020 – Façade bonus, Eco Bonus, Anti-Seismic Bonus

The Italian State has put into effect several building Bonuses in 2020. As the guidelines are not sill completely clear today, we would like to clarify some aspects of these bonuses to better understand, for example, the fields of intervention, the legislation of reference, and - above all - who can benefit from these concessions and how obtain them.

FAÇADES BONUS

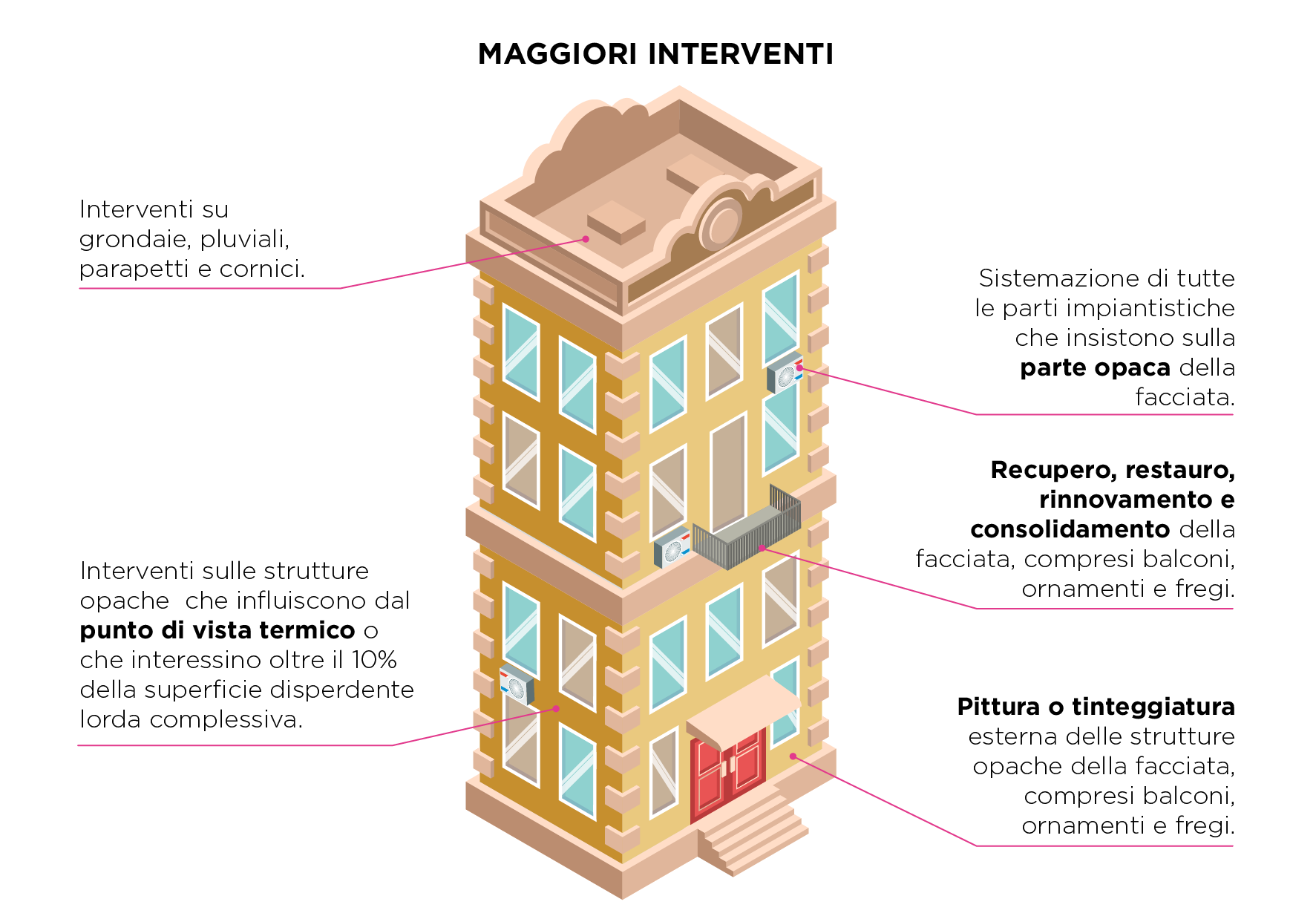

The "Façades Bonus" is the new tax rebate for the recovery of the façades of existing buildings, aimed at incentivizing the recovery of the existing building heritage and improving the urban quality.

FAÇADES BONUS

The "Façades Bonus" is the new tax rebate for the recovery of the façades of existing buildings, aimed at incentivizing the recovery of the existing building heritage and improving the urban quality.

- According to Ministerial Decree 1444/1968, the works eligible for the tax rebate are those carried out in historical centres (zone A), in parts of the Municipal territory, totally or partially built (zone B) or in comparable areas;

- It cannot be combined with other concessions (such as the Eco Bonus);

- The costs incurred for the following works are excluded: interventions on internal façades, not visible from the public street; interventions on surfaces bordering with air shafts, light wells, internal courtyards and spaces; the replacement of windows, doors, window and door frames and gates; buildings under construction or demolition and reconstruction;

- The deductible costs are the following: purchase of materials, planning of the interventions, professional services related to the works, costs connected to the interventions, taxes related to the realisation of the works.

The maximum deductible amount is 90% of the expenditure (including construction works and professional services). Tax exemption of the same amount on IRPEF or IRES, for 10 annual instalments.

ANTI-SEISMIC BONUS

The Anti-seismic bonus is a tax concession that allows to implement static safety measures on buildings located in high seismic hazard areas (zone 1, zone 2 and zone 3, identified according to Prime Ministerial Order No. 3519 of 28 Aprile 2006) and its subsequent amendments and additions. For property unit:

ECO BONUS

The Eco bonus is an incentive for the energy requalification of properties, aimed at obtaining significant economic savings. It can be requested on interventions carried out on a single real estate unit or on common areas of buildings.

ANTI-SEISMIC BONUS

The Anti-seismic bonus is a tax concession that allows to implement static safety measures on buildings located in high seismic hazard areas (zone 1, zone 2 and zone 3, identified according to Prime Ministerial Order No. 3519 of 28 Aprile 2006) and its subsequent amendments and additions. For property unit:

- 50% of the expenses incurred for interventions on structural parts that do not lead to an improvement in the seismic class;

- 70% of the expenses incurred for interventions on structural parts that reduce the seismic risk of 1 class;

- 80% of the expenses incurred for interventions on structural parts that reduce the seismic risk of 2 classes.

- 75% of the expenses incurred for interventions on structural parts that reduce the seismic risk of 1 class;

- 85% of the expenses incurred for interventions on structural parts that reduce the seismic risk of 2 classes.

- Existing buildings;

- Demolition and reconstruction of a building without volume increase;

- Renovation with expansion works, only for the expenses relating to the building portion already existing.

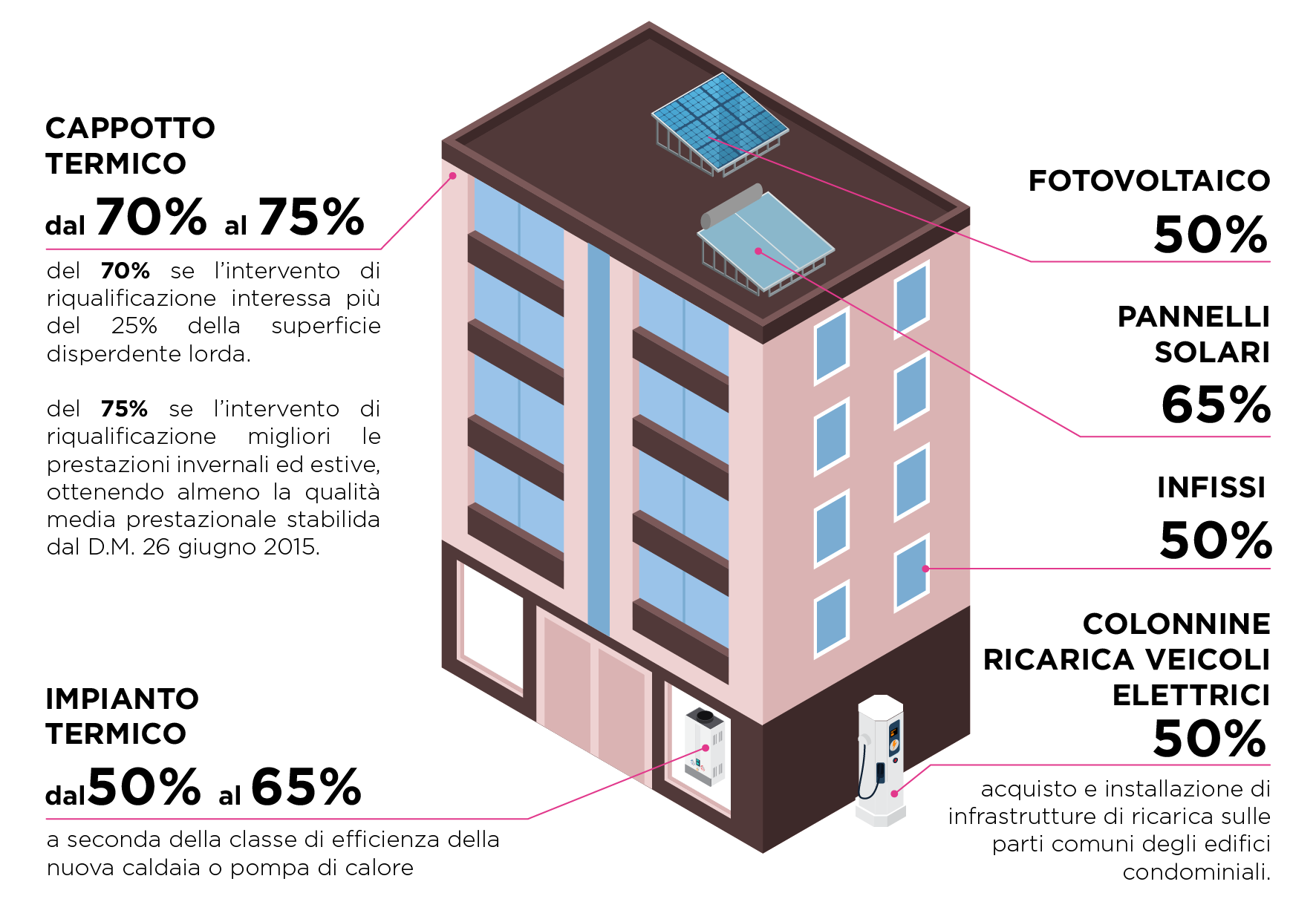

ECO BONUS

The Eco bonus is an incentive for the energy requalification of properties, aimed at obtaining significant economic savings. It can be requested on interventions carried out on a single real estate unit or on common areas of buildings.

- Solar panels - Installation of solar panels for the production of domestic hot water, deductible expense of 65%;

- Photovoltaic panels - Installation of photovoltaic panels for the production of electricity, deductible expense of 50%;

- Thermal cladding - Realisation of a thermal cladding to improve the thermal performance, deductible expense from 70% to 75%;

- External door, windows - Replacement of the old fixtures with new high-performance ones, deductible expense equal to 50%;

- Heating system - Replacement of the old boiler with a new condensing boiler, or heat pump installation, deductible expense from 50% to 65%;

- Electric vehicles - Installation of charging stations for electric vehicles, deductible expense of 50% on a maximum amount of 3,000 €.

The maximum deductible amount is 40.000 €, both for real estate unit and for common areas of condominium buildings. Tax exemption for 10 equal annual instalments (by December 2020).

I contenuti presenti nella brochure redatta del febbraio 2020 fanno riferimento alle disposizioni Normative vigenti.

Dati e informazioni potrebbero subire eventuali modifiche o integrazioni a seguito di aggiornamenti delle Normative.