The 110% Superbonus and the FAD Studio’s services for you

Driving and drew in interventions: how we can help you

First of all, it is important to specify that the Superbonus is a benefit provided by the Relaunch Decree which increases the deduction rate for the expenses incurred from 1st July 2020 to 30 June 2022 to 110%, for specific works aimed at the implementation of energy redevelopment works and anti-seismic interventions on buildings.

These new measures complement the deductions provided for the restoration works of the building heritage, including those for the abatement of the seismic risk (the Sismabonus) and those for the energy redevelopment of buildings (the Ecobonus).

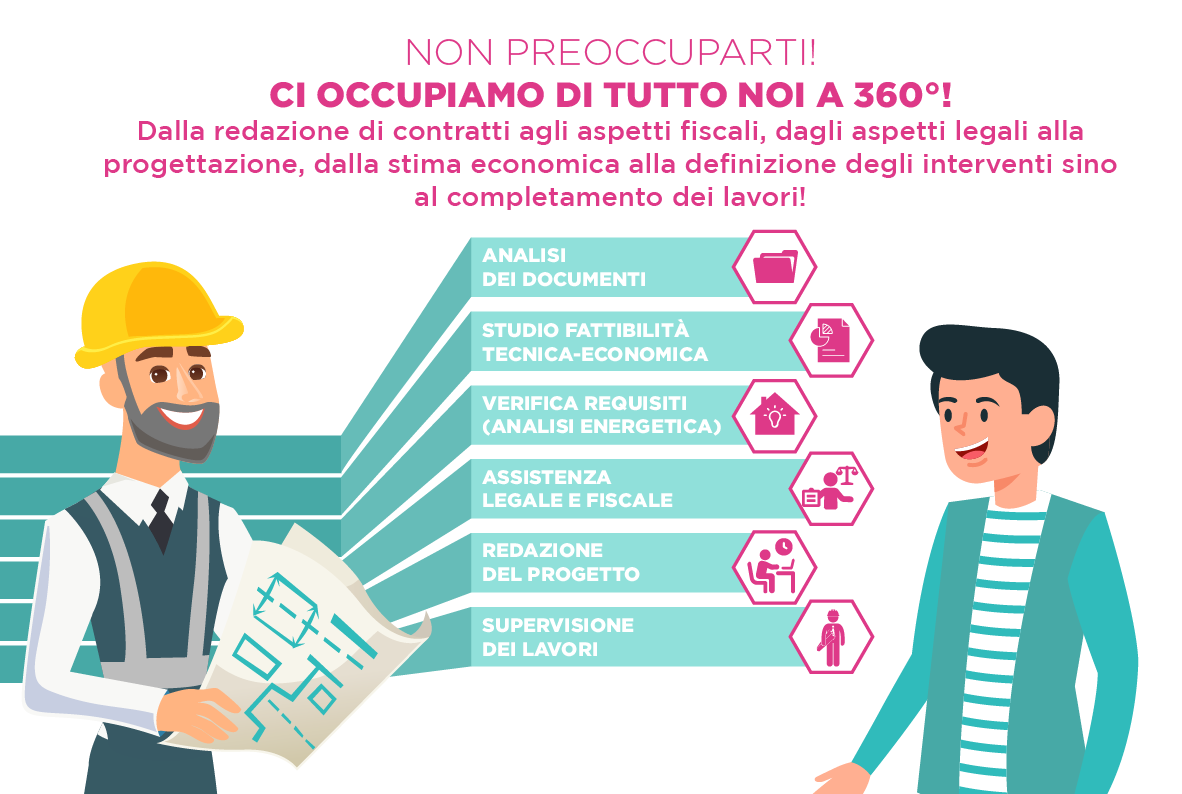

The 110% Superbonus is therefore a great opportunity and it is advisable to rely on competent technicians to exploit it to the fullest. A technician can help and assist you step by step in carrying out all the procedures, up to the execution of the works. Our team will manage all the procedures at 360°, according to structured phases as shown below.

Let us see the aspects of the 110% Superbonus in detail.

Who can benefit of the Superbonus?

- Owners in multi-family buildings;

- Individuals;

- Autonomous Institutes of Public Housing;

- Cooperatives and Onlus;

- Sports clubs and associations.

How to get the Superbonus?

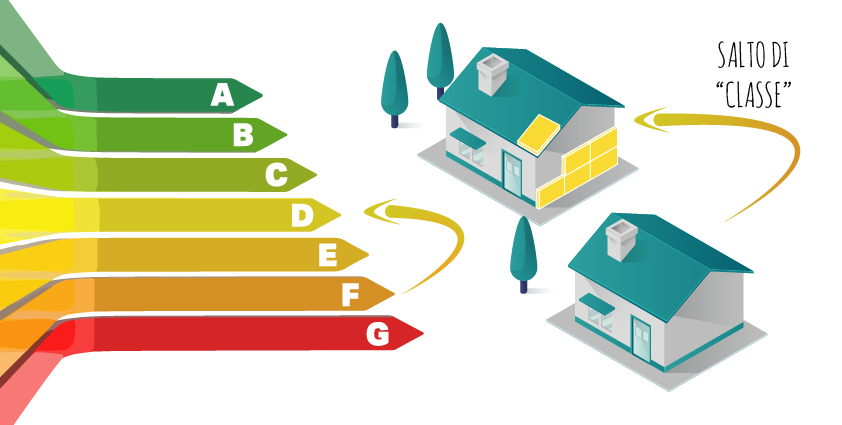

To obtain the tax concessions of the Bonus, the town planning-building compliance of the property is necessary. The interventions as a whole must ensure the improvement of at least two energy classes of the building (or of the real estate units located inside multi-family buildings); the improvement must be certified by the Energy Performance Certificate to be obtained before and after the intervention.

DRIVING INTERVENTIONS

Thermal insulation of the building envelope

This refers to thermal insulation of opaque vertical, horizontal, and sloped surfaces of the building envelope, including the single-family ones. The intervention must involve the 25% of the surface at least.

The maximum cost for the intervention changes according to the different types of housing:

- Single-family or detached building: € 50,000

- Buildings up to 8 real estate units: € 40,000

- Buildings with more than 8 real estate units: € 40,000 for the first 8 units and € 30,000 for the subsequent units.

Replacement of winter climate control systems

These works are performed on common parts of multi-family and single-family buildings, and include interventions such as: centralised systems, micro-cogeneration plants, solar collector systems, etc.

The maximum cost for the intervention changes according to the different types of housing:

- Single-family or detached building: € 30,000

- Buildings up to 8 real estate units: € 20,000

- Buildings with more than 8 real estate units: € 20,000 for the first 8 units and € 15,000 for the subsequent units.

"Sismabonus" and anti-seismic interventions

These are interventions aimed at the seismic improvement and adaptation of buildings or of structurally connected building complexes, located in the seismic zones 1, 2 and 3.

The spending amounts eligible to the Superbonus are:

- Interventions on individual real estate units: € 96,000

- In case of purchase of anti-seismic houses: € 96,000

- For interventions on common parts of multi-family buildings: € 96,000 multiplied by the number of real estate units in each building.

DREW IN INTERVENTIONS

These are all the energy efficiency interventions to which the 110% deduction is applied, only if carried out together with at least one of the driving interventions.

Solar panels: Installation of solar panels for the production of domestic hot water for domestic and industrial use.

Photovoltaic panels: Installation of photovoltaic panels for the production of electricity. The spending limit is € 2,400 for each kW of power.

Storage system: Installation of storage systems integrated into the photovoltaic systems. The spending limit is € 1,000 for each kWh of storage capacity.

External windows: Replacement of windows including frames and shutters.

Solar shields: Installation of solar shielding systems integral with the building envelope.

Building automation: Automatic management systems for heating, domestic hot water, or summer climate control systems.

Charging columns: Installation of charging columns for electric vehicles.

Lifts and goods lifts: Interventions for the elimination of architectural barriers with the installation of lifts and goods lifts. This can be applied only if people with severe handicaps or over 65 years are present.

TAX DEDUCTIONS